About Silicone Food Wrap

Do you know Silicone Food Wrap?Its quality is better than normal food wrap.It's made of fda silicone,so you don't worry about its safety.Why not use this kind of Silicone Wrap instead of regular food wrap? It will be your best choice!

1.Product name:Silicone Food Wrap,Silicone Wrap,Silicone Reusable Food Wrap,Silicone Wrap Film,Silicone Cling Wrap,Silicone Wrap Seal Cover

2.Place of origin:Guangdong China

3.Color:any pantone color

4.Effect:Any effect according to customer's requirement

5.MOQ:500pcs.

6.Package:1 pcs/opp,customized design is available.

7.Design:Customized/stock

8.Certification:FDA,LFGB,SGS,ROHS,etc.

9.Usage:Use for food sealing

10.Silicone Food Wrap photos for reference.

Silicone Food Wrap,Silicone Wrap,Silicone Reusable Food Wrap,Silicone Wrap Film,Silicone Cling Wrap,Silicone Wrap Seal Cover Dongguan OK Silicone Gift Co., Ltd. , https://www.dgsiliconekitchenware.com

Creates an air tight seal keeping food fresh. Long lasting,can be used again and again.

Dishwasher, refrigerator, and microwave safe.BPA Free. Easy to clean.

Great alternative to plastic wrap made from food grade silicone.

Here is our Hot Selling Silicone Food Wrap:Silicone Wrap,Silicone Reusable Food Wrap,Silicone Wrap Film,Silicone Cling Wrap,Silicone Wrap Seal Cover.

Product introduction:

In 2017, the cobalt material market changed its potential, and the price of cobalt rose.

Since 2017, the domestic cobalt market has entered a rising range. The metal cobalt in 2017 (as of December 25, 2017) was as high as 97.35%, setting a new high in the cycle (cycle refers to 2011-09-01 to date). Overall, the annual cobalt price is in an upward trend. Although there is a price drop in the middle, it is generally difficult to hinder the upward trend of cobalt prices. For specific analysis, in January and February, the first wave of 2017 surged, with a rise of 42.09% (as of February 28); from March to June, the price of cobalt fluctuated between 360,000 and 400,000; At the beginning, the price of cobalt rose by 33.51% (July 1 to December 25). It began to grow rapidly in late November, rising 16.53% in 20 days (November 20-December 19), and set the highest price point in the price cycle on December 14 (cycle refers to 2011-09-01 to date). The uptrend began to fall back until mid-December. As of December 25, 2017, the average price of metal cobalt market was 534,500 yuan / ton.

Market analysis

1. Basic situation of cobalt mine:

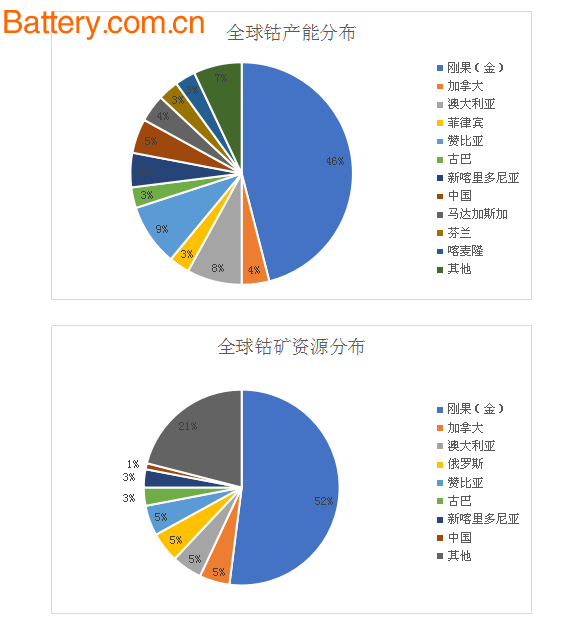

As can be seen from the above figure, China's cobalt resource reserves account for only 1% of the global total, and cobalt mine capacity accounts for 5% of global capacity. There is a shortage of cobalt resources, and the import dependence is over 90%, mainly relying on imported cobalt raw materials. International cobalt price changes and market changes have a huge impact on domestic cobalt prices.

2. Analysis of the next parade

(1) Composition of downstream consumption

Among the global cobalt consumption components, battery materials account for the highest proportion, accounting for nearly 60%. The battery field is mainly used for 3C batteries, power batteries and energy storage batteries; high temperature alloys are mainly used in aviation jet engines, ship gas turbines, industrial gas turbines. Guide vanes, diesel nozzles, vanes, etc.; hard alloys are mainly used in production tools (tools, molds and minerals).

In China's cobalt consumption composition, battery consumption accounts for 78%, mainly used in mobile phones, cameras, computers and other electronic products as well as new energy vehicle battery materials. The battery for new energy vehicles is the main driving force for the future growth of cobalt consumer batteries, which directly determines the cobalt market.

(2) analysis of the next parade

As can be seen from the above figure, in November 2017, the production and sales of new energy vehicles completed 122,000 and 119,000 respectively, up 32.8% and 30.5% respectively, up 70.1% and 83% respectively. From January to November, the production and sales of new energy vehicles were 639,000 and 609,000 respectively, up 49.7% and 51.4% respectively. In 2017, the production and sales volume of new energy vehicles is expected to exceed 710,000 units. The consumption of new energy vehicles has grown rapidly, driving the continued growth of cobalt consumption.

Superalloys are mainly used in the manufacture of engines (including aero engines, aircraft, naval engine industrial gas turbine engines, etc.). Benefiting from China's “Beidou Planâ€, “嫦娥 Plan†and “China Space Station Planâ€, China's future aviation engine demand will continue to increase. The increase in demand for superalloys has led to continued growth in cobalt consumption.

Beginning in the second half of 2016, countries around the world have given timetables for banned fuel vehicles, which has greatly accelerated the development of electric vehicles. At the State Council meeting in October 2016, China decided not to approve the construction of new traditional fuel vehicle production enterprises. At the same time, from 2015 to the first half of 2017, a total of 202 new energy vehicle production projects were launched in China, involving investment amounts. For over RMB 100 billion, the planned capacity has exceeded 20 million units. At the same time as the rapid development of electric vehicles, the supply of power batteries is particularly important in the “heart†part. Power batteries rely on a large number of metal raw materials such as lithium, nickel and cobalt. Among them, cobalt is a rare resource, and the rise in cobalt price is inevitable.

Entreprise's news:

Cobalt 27 acquired 2157.5 tons of metallic cobalt as inventory when it was listed on the GEM on June 23, 2017, including 1486.5 tons of high grade cobalt and 671 tons of low grade cobalt. On December 7, international giant Cobalt27 announced that it had reached an agreement with the underwriting syndicate led by TD Securities and Scotiabank, which used the net proceeds of issuing new shares of C$85 million to purchase 720 tons of high-grade metal cobalt. The spot supply of cobalt is only 6,000-7,000 tons. The acquisition of Cobalt27 significantly reduces the circulation of cobalt in the market, causing supply shortages and greatly benefiting the rise in cobalt prices.

International News:

The US International Trade Commission (ITC) initiated a 337 investigation into China's glycated stevioside, lithium batteries and their components. The US investigation of lithium batteries in China has affected the export sales of lithium batteries, which has a negative impact on the demand for metallic cobalt.

As the world's largest producer of cobalt resources, the Congolese government has been turbulent, seriously affecting the supply of cobalt raw materials. The cobalt supply pressure becomes large. Less supply, pushing the price of cobalt to continue to rise.

Policies and regulations:

The Congo (Golden) lower house raises taxes and taxes through the new mining law, Congo (Gold) is Africa's largest copper producer, an important gold producer, and the world's leading cobalt supplier, the Congo (Golden) raises taxes and fees. The mining tax will definitely reduce the profits of enterprises and have a positive impact on the growth of cobalt prices.

Outlook outlook

In 2017, the price of cobalt in the market rose all the way, and the good news in the cobalt market continued. On the demand side, the continued growth of new energy vehicles has led to a growth in cobalt consumption. On the supply side, the Congo (Golden) political turmoil has affected the supply of cobalt resources. However, while paying attention to good news, we must also pay attention to the risks in 2017. The international giants have purchased a large amount of high-cobalt cobalt. While frying high cobalt prices, it also caused the risk of excessively rising cobalt prices. The investigation reduced the export of lithium batteries and limited the demand for cobalt.

In the long run, the demand for metallic cobalt will increase rapidly, and it will be in short supply for a long time, and the price of cobalt is difficult to fall. However, in the short term, there is a risk of lowering the price of cobalt. Now the international cobalt price is much lower than the domestic cobalt price, while the domestic metal cobalt is heavily dependent on imports. The international cobalt price is closely related to the domestic cobalt price. At this stage, the domestic cobalt price is not enough. Business analysts believe that in general, cobalt is still in short supply in 2018, cobalt prices still have room to rise, but due to the early rise in cobalt prices, cobalt prices may have a small correction in the short term, with the increasing demand for cobalt After the Spring Festival, cobalt prices began to grow steadily.