Injection Molding Magnet,Injection Molding Magnetic Material,Insert Molding Magnets,Injection Molded Neodymium Magnets Ningbo YinZhou Haochang Magetic co,LTD , https://www.hcmagetic.com

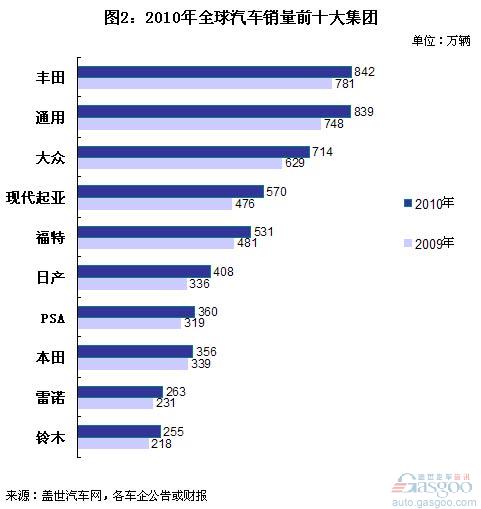

There are still four Japanese car companies in the top ten, among which, except for Nissan, the sales of the other three companies showed a year-on-year decline. Honda and Toyota are in double-digit declines. The fastest growing sales in the top ten were Volkswagen, Hyundai-Kia, and Nissan, all of which had double-digit growth. The following is the specific sales volume change for each group.

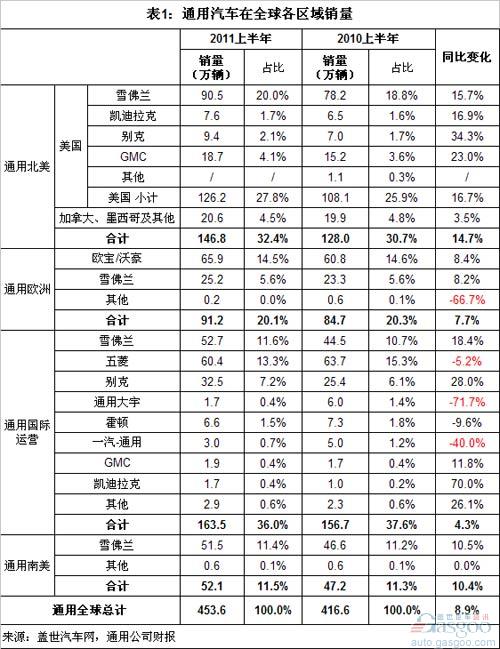

General Motors: International Operations Growth Slowest, North America Fastest

In the first half of 2011, General Motors' global sales volume (indicative volume) reached 4.536 million units, an increase of 8.9% year-on-year. From a business perspective, GM’s sales growth in the first half of the year was the fastest in North America—a 14.7% year-on-year increase to 1.468 million vehicles; the slowest is the area in which GM’s operations are responsible (Asia Pacific, Africa, Middle East, Russia, and CIS ), which only grew by 4.3% to 1.635 million vehicles, and in 2010 this was the fastest growing global area for GM.

The sales volume of GM International Operations includes the brands of joint ventures in China, especially the Wuling brand, which is the highest-selling brand in the business unit. In the first half of this year, Wuling sales fell 5.2% to 604,000 vehicles. Although it was still the highest-selling brand in the department, it was the main reason for the slowest growth of the department. In addition, sales of GM Daewoo and FAW GM also declined by 71.7% and 40.0% respectively in the first half of the year. The sales of Chevrolet, Buick, and Cadillac brands in the region under their jurisdiction have a relatively high growth of 18.4%, 28.0%, and 70.0%, respectively.

Volkswagen: Sales in Asia Pacific, North America, and Central and Eastern Europe increase, share of passenger cars in South America and Central and Eastern Europe declines. Volkswagen Group’s press release showed that global sales in the first half of 2011 were 4.09 million units, up 14.1% year-on-year. Its financial report showed that its global terminal retail sales were 4.133 million, an increase of 15.9% year-on-year; shipments were 4.129 million, an increase of 14.3% year-on-year. The following is the volume of sales for each brand, including the brands in the holding company, and their sales volume around the world.

Among the Volkswagen Group's brands, sales of the two commercial vehicle brands - Scania and Volkswagen Commercial Vehicles - rose the fastest in the first half of the year by 42.3% and 29.0%, respectively, followed by Skoda, Bentley and Audi, respectively. Increased by 20.1%, 19.6%, and 17.7%. The sales of the Volkswagen brand in the passenger car market increased by 11.8% to 2.533 million in the first half of the year. The sales of the SEAT brand in the first half of the year increased by only 2.5%, which was the worst performance among the group's production vehicle brands.

From the sales of the Volkswagen Group in various regions of the world, Western Europe and the Asia-Pacific region are still the regions with the largest and the smallest sales volume. However, sales in Western Europe in the first half of this year accounted for 40.3% of its total sales in the world from 43.0% in the same period last year, while Asia-Pacific sales rose by 1.3 percentage points to 30.5%. Its sales in Asia Pacific mainly come from China. Its sales in this market in China accounted for 26.8% of its total global sales, up 0.5% from the same period last year. In addition to the Asia-Pacific region, sales in North America and Central and Eastern Europe also increased by 0.8 and 0.4 percentage points. However, South American sales fell by 0.3%.

From the performance of the Volkswagen Group in the global passenger car market, the Group’s share of the passenger car market in Western Europe in the first half of the year was 22.5%, up 1.8 percentage points from the same period of last year. Although Asia Pacific is its second largest regional market, its share of the passenger vehicle market in the Asia-Pacific region was only 11.4% in the first half of this year, which is not its market share in South America and Central and Eastern Europe (19.0% and 13.4%, respectively). However, its market share in the Asia-Pacific region increased by 1.6 percentage points from the same period of last year. The share of the passenger vehicle market in China rose by 0.7 percentage points to 18.6%, while its market share in South America and Central and Eastern Europe declined.

North America remains a poor market for the Volkswagen Group. In the first half of this year, its share of the passenger vehicle market in North America was only 4.2%, but it was slightly higher than the same period of last year by 0.3%.

Toyota: Asia-Europe’s share ratio, Japan and the United States decreased to terminal retail sales, sales of Toyota Motor Group in the first half of 2011 (including Daihatsu and Hino sales) was 3.715 million units, down 10.8% year-on-year, including a 22.0 year-on-year decline in the second quarter %; In terms of shipments from the Toyota Plant, in the first half of 2011, the Group sold 3.016 million units, a year-on-year decrease of 22.0%, including a 32.9% year-on-year decline in the second quarter. It is not difficult to see that after a strong earthquake, tsunami and nuclear radiation occurred in Japan in mid-March this year, Toyota’s global production and sales were greatly affected. The following is the volume of sales for its sales, see Toyota's sales in major global markets.

In the first quarter of this year, Toyota’s sales in Europe, Asia (beyond Japan) and Africa continued to increase year-on-year, but Toyota’s sales in all major markets (including Europe, Asia, and Africa) fell from the same period last year.

From the proportion of Toyota's regional auto sales in its global total, the proportion of sales in both Japan and North America was significantly reduced in the second quarter after the earthquake—Japan’s share was down 3.6 percentage points to 23.9%, and North America’s share was reduced. 6.3 percentage points to 22.6%. While the proportion of sales in Asia and Europe increased significantly, this did not happen after the earthquake. In the first quarter of this year, the share of Asia and Europe in Toyota’s global sales increased by 5.6 and 2.3 percentage points year-on-year to 19.3% and 12.3%, respectively. In the second quarter, Asia and Europe accounted for 21.2% and 14.3% respectively. .

According to the group’s announcement on August 2 this year, the terminal retail volume targets of Toyota, Daihatsu and Hino in 2011 were revised to 7.10 million units, 710,000 units and 120,000 units, respectively. The group’s target totaled 7.93 million units, which is higher than the 2010 calendar year. Sales volume decreased by 6%.

Analysis of Global Top 10 Automobile Group Sales in the First Half of 2011 (I)

According to the data compiled by Gasgoo.com, the top ten global auto sales in the first half of 2011 were GM, Volkswagen, Toyota, Hyundai-Kia, Ford, Nissan, PSA, Honda, Renault and Suzuki. Compared with the 2010 sales rankings for the entire year, the changes were only in the top three, that is, Toyota fell from the first to third, and GM and Volkswagen each rose one.