BASF sales increase to 16.3 billion euros Compared with the second quarter of 2016, BASF Group's sales increased by 12% to 16.3 billion euros (approximately US$19.237 billion), which was mainly due to the increase in selling price and sales volume. In the case of rising raw material costs, the company’s selling price rose by 7%; this is mainly driven by the increase in the price of the chemicals business. Sales increase by 3%. The exchange rate factor has a positive effect on sales, and the change in product mix also contributes a 1% increase in sales. Earnings before interest and tax in the second quarter increased by 32% year-on-year to 2.3 billion euros. The strong growth was mainly due to the substantial increase in revenue from the chemicals and oil and gas business. The decline in revenue from the specialty products, functional materials and solutions, and the agricultural solutions business has weakened the growth rate. The EUR 100 million insurance payment made up for the negative impact on revenues due to the North Port accident at Ludwigshafen Base in October 2016. This insurance was mainly allocated to the chemicals business. Net income was EUR 1.5 billion, an increase of EUR 404 million from the same period last year. In the second quarter of 2017, earnings per share were 1.63 euros, compared with 1.19 euros in the same quarter last year. According to special items and intangible assets, adjusted earnings per share after depreciation and amortization was 1.78 euros (1.30 euros for the same period in 2016). Panasonic Automotive Systems achieved sales of 1,865.3 billion yen Driven by stable economic operations in both China and the United States, Panasonic’s auto sales in the first fiscal quarter rose 5% to 1,855.3 billion yen (US$169.974 million). Operating profit increased by 17% to 83.9 billion yen, and pre-tax profit reached 82 billion yen, an increase of 10% compared with the same period of last year. Sales of automotive and industrial systems reached 656.4 billion yen, a year-on-year increase of 13%. Dow Chemical Sales Increases to $13.8 Billion Dow Chemical's second-quarter sales increased to $13.8 billion, a 16% increase from the same period last year. Excluding Corning’s silicone business, Dow Chemical’s sales increased by 8%, and all of its business units’ sales increased. In the second quarter, operating profit without interest, taxes, depreciation, and amortization was US$2.8 billion, an increase of 12% compared to the same period of last year. Except for functional plastics, all business sectors rose. Continental sets sales of Q2 at 11.033 billion euros Continental Group’s tire and ContiTech division’s sales grew by more than 9%, which also included the performance of the Hornschuch Group, which was incorporated into the ContiTech division from March this year. In terms of revenue, due to the substantial increase in raw material costs, the negative impact on the profitability of the rubber group in the first half of the year reached 300 million euros, and the growth resistance faced by the Tire and ContiTech divisions has increased. Continental Group's sales in the second quarter was 11.033 billion euros (about 130.167 billion US dollars), while the first half of sales reached 220.329 billion euros (about 25.9444 billion US dollars). Capital spending in the first six months of 2017 increased by 26% to 1.16 billion euros. In the same period last year, the capital expenditure ratio was 4.6%, and this year it reached 5.3%. The free cash flow before the acquisition in the first half of the year was EUR 531 million, a decrease of EUR 510 million over the previous year. Denso's consolidated operating income was 1,164.9 billion yen. Denso recently released its fiscal revenue for the first quarter of the new fiscal year (April 1, 2017 to June 30, 2017). In the first quarter, Denso's consolidated net income rose by 66.3% to 76.7 billion yen (approximately 684.8 million U.S. dollars), while consolidated operating income was 1,164.9 billion yen (approximately 10.4 billion U.S. dollars), an increase of 6.6%. The total profit was 93.2 billion yen (approximately US$831.8 million), an increase of 38.6% compared to the same period of last year. Magna sales reach $9.68 billion Although light vehicle production in the North American and European markets fell by 3% and 1% respectively in the second quarter compared to the same period of last year, Magna’s sales in the second quarter historically reached 9.68 billion US dollars. Magna's pre-tax income for the second quarter was $762 million, a decrease of 1% compared to the same period of last year. Net income in the second quarter also reached a record of $561 million, an increase of 1% compared to the same period last year. Magna’s first-half sales reached 19.06 billion US dollars, an increase of 4% compared to the same period last year. North American light vehicle production fell 1%, while European light vehicle production rose 1%. In the first half of the year, pre-tax income was $1.57 billion, net income was $1.15 billion, and diluted earnings per share was $3.01, an increase of $126 million, $97 million, and $0.38, respectively, compared to the same period last year. Magna's adjusted EBIT for the first half of the year increased by 8% year-on-year to US$1.61 billion, compared with US$1.49 billion in the same period last year. Entien’s operating income is 8.596 billion yen Entien’s operating income for the second quarter was 8.596 billion yen (approximately US$7.833 billion), which was a decrease of 21.2% compared to the same period of last year. Net sales were 179.047 billion yen, a year-on-year increase of 7%. Net income per share was reached. 7.33 yen. Nettien’s net sales in Asia were 37,175 million yen, which was an increase of 12.7% compared to the same period last year. The sales of post-market applications and automotive applications were 27.369 billion yen and 123.868 billion yen, respectively. DuPont sales of 7.4 billion U.S. dollars In accordance with generally accepted accounting principles, DuPont’s revenue from its continuing business in the second quarter was US$0.97 per share, and its operating income was US$1.38 per share. In the first half of the year, DuPont continued its business with revenue of US$2.50 per share and operating income of US$3.2 per share. The second quarter sales of 7.4 billion US dollars, compared with the same period last year increased by 5%. DuPont’s business segments both rose, with sales in the first half of the year at US$15.2 billion, an increase of 5% compared to the same period last year. Valeo's consolidated sales of 4.697 billion euros Valeo is affected by the growth of LED lights and energy-saving engine systems business. Net income rose by 20% in the first half of the year, exceeding the growth rate of the global automotive market. In the first half of the year, Valeo’s net income rose from 442 million euros last year to 506 million euros, an increase of 20%; while operating income was 9.464 billion euros, a year-on-year increase of 16%. Excluding the impact of acquisitions and exchange rate fluctuations, Valeo's sales for the first half of the year were 9.464 billion euros (US$11.694 billion), a year-on-year increase of 16%. The original equipment sales amounted to 8.235 billion euros, an increase of 16%, which exceeded the global automobile production by 6 percentage points. In the second quarter of 2017, Valeo's consolidated sales amounted to 4.697 billion euros (US$5.543.4 billion), a 12% increase compared to the same period last year. Valeo's original equipment sales in the Chinese market were 548 million Euros in the second quarter, which was a year-on-year increase of 23%. Sales in the Chinese market in the first half of the year amounted to 1.112 billion Euros, a year-on-year increase of 24%, exceeding the growth rate of global automobile production. 21 Percentage. Faurecia sales of 8.585 billion euros In the first half of 2017, Faurecia achieved value-added sales of 8.585 billion euros (US$10.132 billion), an increase of 8.4% on the basis of the report, and 8.5% endogenous growth, which is 550 benchmark points higher than the global automobile production growth rate. . All business units showed endogenous and stable growth with a growth rate of more than 6%. On the customer side, the most significant growth came from Ford (+20% endogenous growth), FCA (+36% endogenous growth), Cummins Commercial Vehicles (+44% endogenous growth) and Chinese OEMs. Twice (+96% of endogenous growth). In the first half of 2017, the positive currency effect (+1.4%) of EUR 109 million substantially offset the negative impact of EUR 117 million (-1.5%) due to the withdrawal of the Fountain Inn (USA) plant. Endogenous growth includes 191 million euros (2.4%) from the joint venture merger (mainly a Changan joint venture in China) (the merger of the Changan Group joint venture in China and the FDA joint venture in Brazil, both All joint ventures are subordinate to the interior business division. Folgaria's operating revenue increased by 20% to 587 million euros; profit margin increased by 60 benchmark points, accounting for 6.8% of value-added sales Lear sales of $5.1 billion In the second quarter, Lear’s sales were US$5.1 billion, an increase of 8% compared to the same period of last year. Excluding the effects of exchange rate changes, Lear’s sales rose by 10% year-on-year in the second quarter. Lear’s net income in the second quarter was $312 million, an increase of 10% compared with $282 million in the same period last year. The core business revenue was US$439 million, an increase of 8.4% compared to the same period last year. In the seat business, profit and adjusted profit increased to 8% and 8.4% of sales, respectively. In the electronic system, profits and adjusted profits increased to 14.2% and 14.9% of sales, respectively. Earnings per share rose 18% to $4.49, while adjusted earnings per share rose 20% to $4.39. The net cash for operating activities in the second quarter was $566 million, while the net cash flow was $413 million. Cummins' operating revenue is $5.1 billion Cummins's revenue for the second quarter of 2017 was US$5.1 billion, which was mainly due to the rapid growth in the demand for trucks and construction equipment in North America and China. In addition, the mining and petrochemical business also became the main driving force for revenue growth. In accordance with U.S. GAAP, Cummins’ net income was US$424 million in the second quarter, or diluted earnings per share of US$253 million. Net income for the same period last year was US$406 million, and diluted earnings per share was US$2.4. The second quarter's tax rate was 26.4%. The EBIT of the second quarter was US$620 million, or 12.2% of sales, and the EBIT of the same period last year was US$591 million. Compared with the same period of last year, it increased by 12%. Delphi's first-half operating income reached $8.6 billion Delphi’s net income in the second quarter rose 42% year-on-year to $386 million due to increased research and development in technologies such as automated driving. Operating income rose 2.7% to US$4.32 billion. In accordance with generally accepted accounting principles, Delphi’s net income from its continuing operations in the second quarter reached US$369 million, while adjusted net income reached US$457 million in accordance with non-GAAP calculations. In the first half of the year, Delphi’s operating income reached US$8.6 billion, a 4% increase over the same period last year. In accordance with generally accepted accounting principles, net income from continuing operations in the first half of the year reached US$704 million. In the first half of the year, adjusted operating income reached 1.124 billion U.S. dollars, compared with 1.092 billion U.S. dollars in the same period of last year. Goodyear's sales of 3.7 billion US dollars Goodyear tire rubber sales in the second quarter of 3.7 billion US dollars, compared with last year's $ 3.9 billion decline, mainly due to the decline in sales volume caused by tire prices. In the second quarter, tires sold a total of 37.4 million pieces, a 10% drop from the same period of 2016, mainly in the European, Middle East, African and American markets. Goodyear’s net income in the second quarter was US$147 million, compared to net income of US$202 million in the same period of last year; adjusted net income in the second quarter was US$177 million, compared to US$314 million in the same period of last year. Goodyear’s first-half sales amounted to US$7.4 billion, a 2% drop from the same period in 2016. In the first half of the year, the sales volume of tires reached 77.4 million, which was 7% lower than the same period of 2016. Goodyear’s net income for the first half of the year was US$313 million, compared to US$386 million in the same period last year. Toyota Textile Net Sales of 332.475 billion yen Toyota Motor’s net sales for the first fiscal quarter were 332.475 billion yen (approximately US$3.029 billion), an increase of 2.4% compared to the same period of last year, and operating profit reached 16.25 billion yen, a year-on-year increase of 1.7%. Earnings per share reached 54.1 yen. Toyota Textile's net sales in Asia and Oceania reached 82.818 billion yen. Autolif’s consolidated sales reached $2.545 billion Autolif’s consolidated sales reached $2.545 billion in the second quarter, and organic sales rose 0.2%. Consolidated sales decreased by 1.3% compared with the same period of last year, of which organic growth was 0.2%. Taking into account changes in exchange rates, integrated sales fell by 1.5%. Operating income was 216.4 million U.S. dollars, an increase of 1.7% compared to the same period of last year, operating profit rate reached 8.5%, and adjusted operating profit rate was 8.4%. In the second quarter, Ottolev diluted earnings per share to $1.47, a year-on-year decrease of 17.7%. With the exception of the Americas market, all major markets have seen growth, with Japan and India as the main driving forces, and the decline in the North American market has reached 6.3%. In the first half of the year, consolidated sales increased by 2.9% from the same period of 2016, organic growth rate reached 2.3%, and acquisitions led to sales growth of 2.4%. Exchange rate changes caused sales to decline by nearly 1.8%. With the exception of the Americas, sales increased in all markets, with Europe, Japan and India as the main drivers. SKF net sales of 20.2 billion kronor SKF's net sales for the second quarter were 20.2 billion kronor (about 2.487 billion U.S. dollars), an increase of 7.5% over the same period of last year, with North American and Asian markets rising by 10% and 12% respectively. Adjusted operating profit was 2,436 million crowns. In the first half of the year, net sales were 39.83 billion kronor, and the adjusted operating profit was 4.793 billion kronor. The development of the automotive business was relatively stable. The adjusted operating profit margin was 8.1%, while the adjusted operating profit margin of the industrial business was 13.8%. BorgWarner Net Sales of $2.39 Billion In the second quarter, BorgWarner’s net sales were US$2.39 billion, an increase of 2.6% compared to US$2.329 billion in the same period last year. Excluding the impact of changes in exchange rates and Remy light car aftermarket business, the second quarter rose 7.8%. In the second quarter, BorgWarner’s net income was US$212 million, or diluted earnings per share of US$1, compared to net income of US$164 million or diluted earnings per share of US$0.76 in the same period last year. The net income in the second quarter of 2017 also included non-comparable data of $0.05 per diluted share, while the non-comparable data for the same period of last year was $0.08 per diluted share. In the first half of 2017, BorgWarner’s net sales were $4.797 billion, an increase of 4.3% compared to $4.598 billion in the first half of last year. BorgWarner’s net income for the first half of the year was US$401 million, diluted earnings per share was US$1.89, net income for the same period last year was US$329 million, and diluted earnings per share was US$1.51. Tenneco's net income reaches $2.317 billion Driven by the two product lines of driving performance and air purification, Tenneco’s net income in the second quarter reached US$2.317 billion, which is an increase of 5% compared with the same period of last year. Assuming a constant exchange rate, Tenneco’s operating income rose by 6% in the second quarter. The EBIT of the second quarter reached $28 million, while the adjusted EBIT rose to $179 million. Excluding the $8 million in damage caused by the impact of exchange rate changes, the adjusted EBIT was $187 million. Infineon's operating income is 1.831 billion euros Infineon's operating income for the third fiscal quarter of fiscal year 2017 was 1.831 billion euros (US$21.602 billion), a year-on-year increase of 4%. Third-quarter net income was 253 million euros, an increase of 27% compared to the same period last year. Diluted earnings per share were 0.22 euros, while the adjusted diluted earnings per share was 0.24 euros. Gross profit in the third quarter was 38.2%, and adjusted gross margin reached 39.4%. Dana sales of 1.84 billion US dollars Dana’s total sales in the second quarter of 2017 reached 1.84 billion U.S. dollars, an increase of 19% compared with last year’s 1.55 billion U.S. dollars. The increase in sales was mainly influenced by the acquisition, new consumer projects, high-end demand in the global light truck market and the increase in demand in the global off-road terminal market. Dana’s net income in the second quarter was US$71 million, compared to US$53 million in the same period last year. The increase in net income was mainly due to an increase of 39 million yuan in EBITDA before adjustments to interest, taxes, depreciation and amortization (EBITDA). Dollar drive. In the second quarter, EBITDA was US$217 million, and the profit margin was 11.8%, an increase of 30 basis points over the same period of last year. Sensata’s operating income is US$839.9 million Sensata’s operating income for the second quarter was USD 839.9 million, which was an increase of 1.5% compared to the same period last year. Excluding the 2.1% change in exchange rate, Sensata’s organic growth in the second quarter reached 3.6%. Net income in the second quarter increased by 21.3% year-on-year to 79.5 million U.S. dollars, and 9.5% of operating revenue. Adjusted net income increased by 11.8% to US$139 million. In the first half of the year, Sensata’s operating income was US$1.6471 billion, an increase of 1.4% over the same period of last year. Excluding the impact of exchange rate changes, Sensata’s organic growth reached 3.6%. In the first half of the year, net income increased by 19.9% ​​to US$151.2 million, while adjusted net income rose by 9.7% to US$260.5 million. Visteon sales of $774 million Visteon’s sales for the second quarter of 2017 were US$774 million, a slight increase compared to US$773 million in the same period last year. Net income for the second quarter was $45 million, or diluted earnings per share of $1.41. Net income for the same period last year was $26 million, and diluted earnings per share was $0.76. In the second quarter, sales of Visteon’s electronic business were US$774 million, compared to US$762 million in the same period of last year, while net income in the second quarter of the electronic business was US$45 million, or diluted earnings per share of US$1.41, compared to the same period last year. Net income is $43 million and diluted earnings per share is $1.25. Aisin Seiki's net profit reached 280.3 million U.S. dollars In the first quarter, affected by special projects, net profit of Aisin Seiki fell by 25% to US$280.3 million (approximately 31.49 billion yen), and its operating profit fell 9.3% to US$476.6 million compared with the same period last year. In the first quarter, Aisin Seiki and Shiroki Corp exchanged stocks, which increased operating income by US$173.6 million. Excluding the proceeds of the stock exchange and other special items, Aisin Seiki's operating income reached US$470 million, a year-on-year increase of 19%. Otaru Manufacturing's net sales amounted to 219.34 billion yen Otaru Manufacturing Co.’s net sales for the first quarter of fiscal year 2018 reached 219.34 billion yen (approximately US$212.2 million), an increase of 17% compared to the same period last year. Operating income for the first fiscal quarter was 23.283 billion yen, a year-on-year increase of 34.6%. Otaru's sales in the Chinese market grew by 18.8% to 58.7 billion yen, which was mainly driven by the steady growth of auto production in the Chinese market and the decline in the tax rate of compact cars. Andorto’s net income grows to US$204 million In the first fiscal year following the dismantling of Johnson Controls, Andorto’s net income rose to US$204 million in the third fiscal quarter, and diluted earnings per share was US$2.17. The adjusted diluted earnings per share increased in accordance with generally accepted accounting principles. 4% to 2.52 USD. The adjusted EBIT rose to 336 million U.S. dollars, and the profit rate reached 8.4%. ThyssenKrupp Q3 net income reached 134 million euros ThyssenKrupp’s sales rose by 11% in the third quarter of the 2016/2017 fiscal year, compared with a 9% year-on-year increase in the first three quarters. The group's adjusted EBIT for the first three quarters increased by 37% to 1.376 billion euros, while the third quarter rose by 41% to 620 million euros. The third quarter net income reached 134 million euros, an increase of 8% compared to the same period last year. The net loss in the first 9 months reached 751 million euros. Schaeffler's first-half operating income reached 7 billion euros According to Schaeffler's preliminary data for the first half of 2017, operating income in the first half of the year reached 7 billion euros (approximately US$8,288.6 million), assuming a constant exchange rate, an increase of 3.8% from the same period of last year. The pre-tax profit before special items was 780 million euros, which led to an 11.1% electric profit before interest and tax that was not included in special items in the first half of the year. In the first half of the year, net income was basically the same as last year, reaching 485 million euros, compared with 494 million euros in the same period last year. Hella sales reached 6.585 billion euros Hella 2016/2017 fiscal year (June 1, 2016 to May 31, 2017) Adjusted EBITDA climbed 12% to 534 million euros, while adjusted EBITDA increased by 0.6 percentage points to 8.1 %. Adjusted sales rose by 3.7% to 6.585 billion euros (US$7.768 billion), compared to 6.352 billion euros in the same period of last year. The sales growth of the automotive business reached 3.8% to 5 billion euros. The growth in demand for innovative lightweight solutions and electronic products was the main driving force. The adjusted EBIT of the business increased by 13.8% year-on-year to 444 million euros. GKN Sale reached 4.879 billion pounds GKN's sales in the first half of the year (organic sales growth of 5%) rose 15% to 4.879 billion pounds (about 6.331 billion US dollars), while pre-tax profits rose by 559 million pounds, compared with 182 million pounds in the same period last year. The organic sales of GKN's powertrain business rose by 8%, far higher than the global automotive output. Haistempu's operating income reached 4.131 billion euros Haistam’s operating income in the first half of 2017 historically reached 4.131 billion Euros (approximately US$4.8738 billion), an increase of 10.4% over the same period of last year. Unearned profits, taxes, depreciation and amortization (EBITDA) were 452 million euros, a year-on-year increase of 11.1%. In the first half of the year, Haistump’s net profit reached EUR 116 million, an increase of 27.2% compared to the same period of last year. Assuming a constant exchange rate, sales growth will reach 11.2, while EBITDA will increase by 12.8%. Full-resistant plastics' first-half operating income was 4.062 billion euros In the first half of the year, the total operating income of Quannyi was 4.062 billion euros, which was 27.8% higher than the same period of last year. The comprehensive fiscal revenue reached 3.455 billion euros (about 4.792 billion US dollars), a year-on-year increase of 29.9%. Operating profit was 325 million euros, an increase of 21.5% compared to the same period last year. Profit before interest, taxes, dilution, and depreciation was EUR 469 million, an increase of 22%. Michelin's first-half net profit reaches 863 million euros Michelin's net profit for the first half of 2017 reached 863 million euros (about US$1.0182 billion), an increase of 12% compared to the same period of last year, sales volume increased by 4.1% (of which the constant scope was 3.6%), and operating profit of recurring businesses reached 1.40 billion euros , The growth is stable, in line with the Group's development plan, confirmed 2017 goals. Sales increased by 4.1% in the first half of 2017 due to a large number of purchases before the first quarter price increase, sales growth slowed in the second quarter, sales of passenger car tires and light truck tires rose (up 3%), truck tire sales Smoothness: The demand for mining tyres continued to pick up. The sales volume of the original market construction machinery tires and agricultural tyres increased rapidly; in December 2016, Levorin, a Brazilian motorcycle tyre manufacturer, was acquired. The favorable price/product mix effect in the first half of the year was 1.4%, which accelerated to 2.8% in the second quarter, reflecting the initial impact of price growth. The negative price/product mix and raw material impact in the first half of the year was EUR 186 million. Biluochun,Maofeng,Tieguanyin,famous tea Hunan Junshan Yinzhen Tea Industry Co.,Ltd , https://www.junshan-tea.com

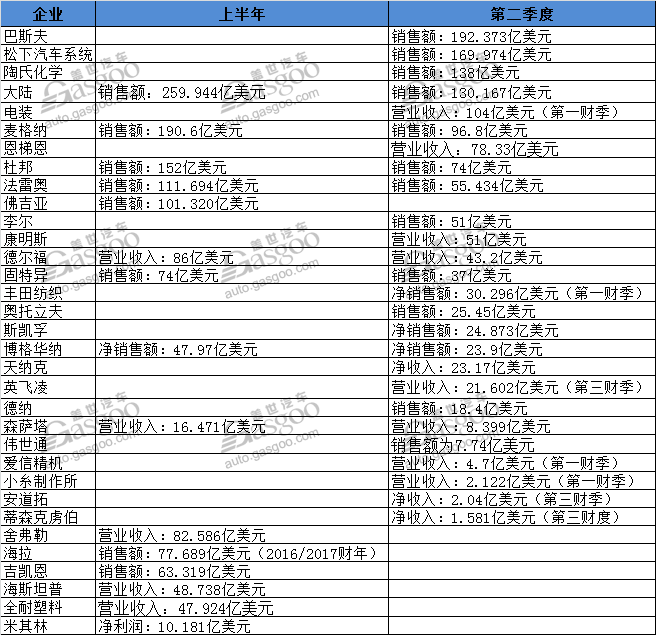

The second quarter of 2017 has quietly ended. The major auto parts suppliers in the world have also announced revenue revenues for the second quarter and the first half of the year. The following is the income of some mainstream auto parts companies that Gasgo Motors has compiled for everyone. For reference, the future will continue to update.

![]()